What Documents Are Needed for KYC: My 2026 Experience

Quick Answer to the Main Question

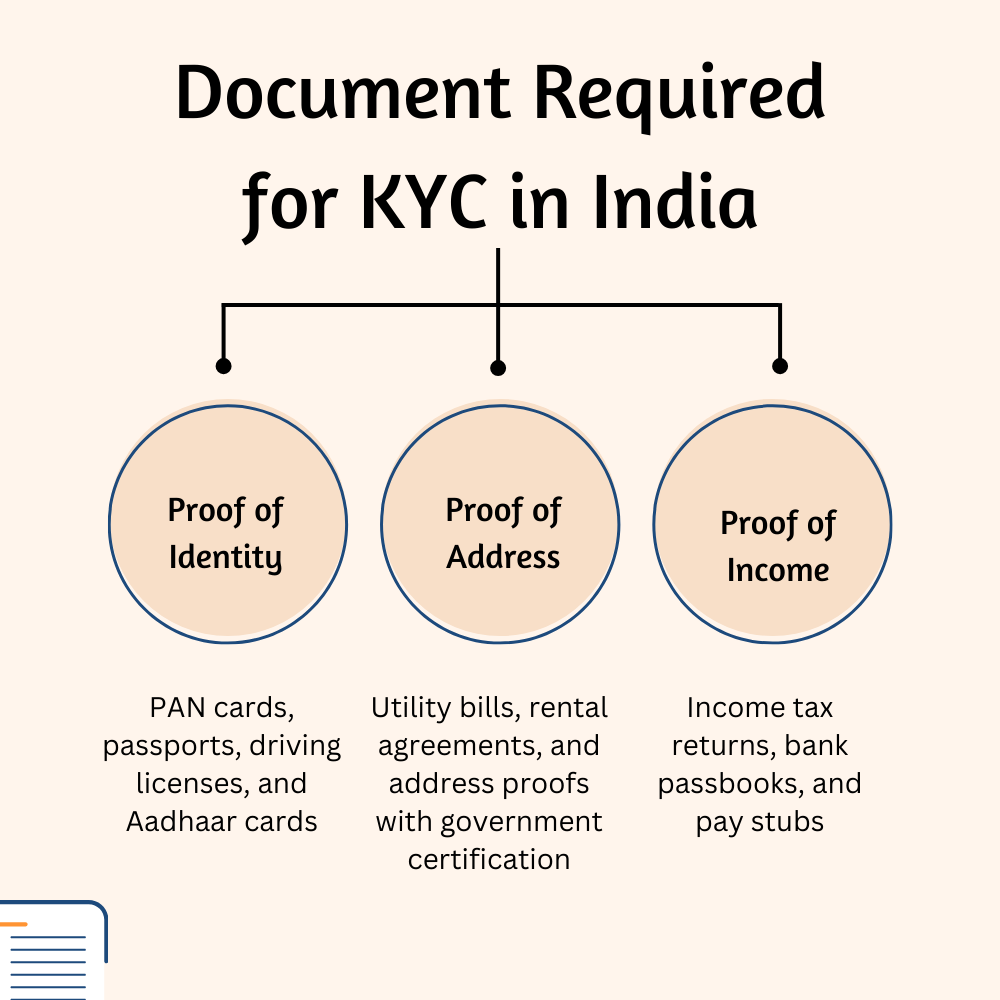

In 2026, the essential documents for KYC (Know Your Customer) verification at online casinos and gaming sites are generally a government-issued ID, proof of address, and sometimes proof of payment method. The specifics can vary depending on the platform, but these are the core requirements most operators stick to. Prepare these in advance to avoid delays in your account verification process.

5 Facts About 'What Documents Are Needed for KYC' That You Didn’t Know

- Some sites may ask for additional documents depending on your country or the amount you wish to deposit.

- High RTP games with high wager limits can trigger more thorough checks, requiring extra proof of income or source of funds.

- Digital copies are usually accepted, but some operators might request original documents sent via postal mail for extra security.

- Expired documents are often rejected; always check the validity dates before submitting.

- It’s not just about compliance—it’s also a way for platforms to protect you from fraud and money laundering.

Detailed Answers

What types of ID are accepted for KYC?

Most sites accept a valid passport, driver’s license, or national ID card. Make sure the document is current and clearly readable. Some platforms may accept identity cards from specific countries, but it’s best to verify beforehand.

How do I confirm my address?

Typically, a recent utility bill, bank statement, or official government letter will do. The document should include your full name and address, and be issued within the last three months.

Is proof of payment required?

Yes, especially if you plan to deposit large sums. Proof of payment might be a screenshot of a bank transfer, a receipt from an e-wallet, or a card statement showing your name and card details (with sensitive info masked). This helps platforms verify the source of funds, which is vital in 2026’s regulatory environment.

Are there any other documents I might need?

In some cases, platforms request additional proof depending on your location or the amount wagered. For example, a selfie holding your ID or a video verification might be required. Always check the specific requirements of your chosen site.

Banking Limits

| Method | Min Deposit | Max Withdrawal | Speed | Fee |

|---|---|---|---|---|

| Bank Transfer | $20 | $10,000 | 1-3 days | Varies |

| E-wallet | $10 | $50,000 | Instant to 24 hours | Low or none |

| Credit Card | $20 | $5,000 | Immediately | Varies |

Rating of Safe Sites

Choosing a trustworthy platform is more important than ever in 2026. Always look for a license from a reputable authority, such as the Malta Gaming Authority or the UK Gambling Commission. Platforms with positive reviews, transparent policies, and up-to-date security measures are your best bet. Remember, a proper KYC process isn’t just a formality—it's a safeguard for your funds and personal data.

Conclusion

By 2026, the list of documents needed for KYC might seem standard, but the process becomes more streamlined thanks to technology and stricter regulations. Have your ID, proof of address, and payment proof ready. Doing so speeds up verification and lets you enjoy your favorite games sooner. Stay informed, stay safe, and remember—good documentation is your passport to hassle-free gaming.